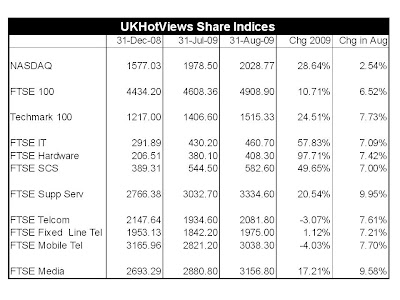

The UK FTSE SCS Index rose another 7% - that’s an amazing 50% YTD. Star performers this month were Anite (up 39% benefiting from a series of positive press and broker comment) and Computacenter (up 21% - see our 27th Aug post - Computacenter winning UK services share.) Outside of the FTSE SCS Index, A trio of stocks put on 69% gains. Sanderson arranged new banking facilities, Highams (that’s what happens when a penny stock rises from 1.1p to 1.9p) and Parity because of encouraging signs in their H1 report.

Telcom – up 8% - is dominated by BT and Vodafone (both up 9%).

NASDAQ was not quite so bullish – managing a modest 2.5% rise – with similar modest performances from the big tech players like HP, Microsoft and Oracle.

Among the India-based players, telco services firm, Sasken, took pole position (+36%), just ahead of Mastek (see Mastek – the ‘Little Indian Battler’) at 35%. Star among the majors was HCL (+27%) after showing a clean pair of heels to larger peers in the recent quarter (see HCL streaks past peers). Poor showing from a couple of the BPO pure-plays, with Genpact down 9% and ExlService down 4%. This was not apparently a ‘BPO thing’ as Firstsource (nee ICICI OneSource) soared 31%.

There was a more muted stock performance from the European IT services majors, with Capgemini up 6% and Atos Origin up 5%. The smaller players did much better – Dutch ‘local hero’ (but much troubled) Ordina topped the list, up 34%, Sopra up 14% and Steria up 12%.

So is all this euphoria justified? Indeed will all this continue? When we wrote on 26th Aug of Fujitsu’s major redundancy programme, which has lead to a forecast of a 7% decline in its UK revenues, other analysts suggested they were an isolated case and pointed to the 5 year/£1.5b megadeal from BP this week as an example of a bouyant IT market. But BP was an excellent example of the severe competition in the IT market which is contributing to market contraction.

Then observers pointed to Intel on Friday as a tech bellwether indicating better times ahead. As I said in my post the day before – Dell and the netbook effect - consumers in particular are switching to low price netbooks (and smartphones) which benefit Intel. But I have severe doubts that enterprises are about to start buying fully priced PCs and laptops again.

Observers must remember that the renewal of a megadeal at a significantly lower price actually reduces the market size. Observers should remember that a bull consumer tech market is not the same as a bull enterprise IT market. Observers should remember that Acer said last week that it needs to sell six netbooks to make the same profit as one regular notebook. In some ways, the more Atom chips that Intel sells, the worse it will be for the HPs and Dells of this world.

No comments:

Post a Comment